44 payment coupon for irs

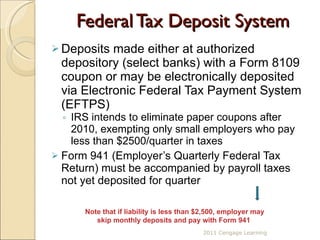

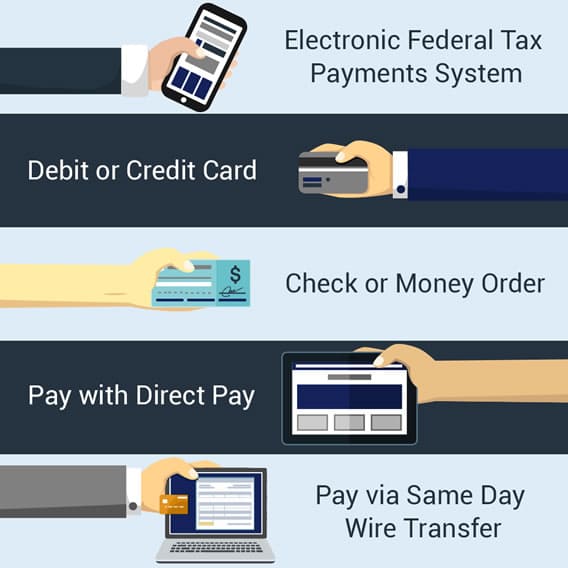

7 Ways To Send Payments to the IRS - The Balance EFTPS saves your payment history for up to 16 months. 1 Online by Debit or Credit Card You can pay the IRS by credit or debit card, but you must use one of the approved payment processors. Three processors are available. You can access any of them on the IRS website or through the IRS2Go mobile app: PayUSATax.com Pay1040.com ACI Payments, Inc. › newsroom › irs-operations-during-covidIRS Operations During COVID-19: Mission-critical functions ... Oct 13, 2022 · Taxpayers can ask for a payment plan with the IRS by filing Form 9465. Taxpayers can download this form from IRS.gov and mail it along with a tax return, bill or notice. Some taxpayers can use the online payment agreement application to set up a monthly payment agreement without having to speak to the IRS by phone.

What is a Credit Card Payment Coupon? - WalletHub A credit card payment coupon is a paper slip with payment information, such as the due date and the card's statement balance, that is meant to be sent along with a check when paying a credit card bill by mail. Payment coupons, which can be found attached to credit cards' monthly statements, may also have the full or partial credit card ...

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Payment coupon for irs

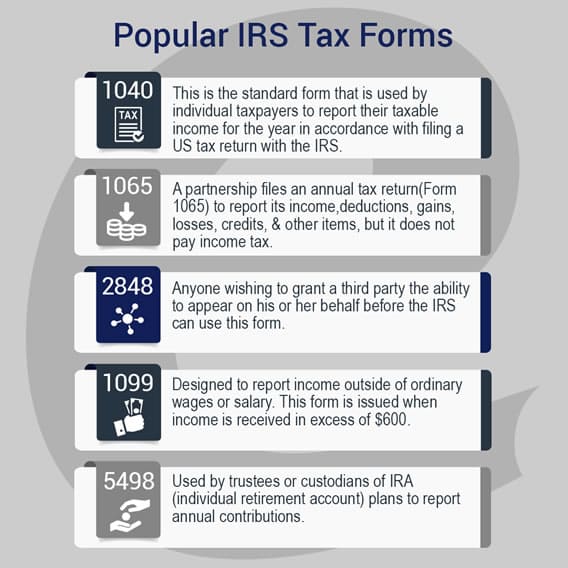

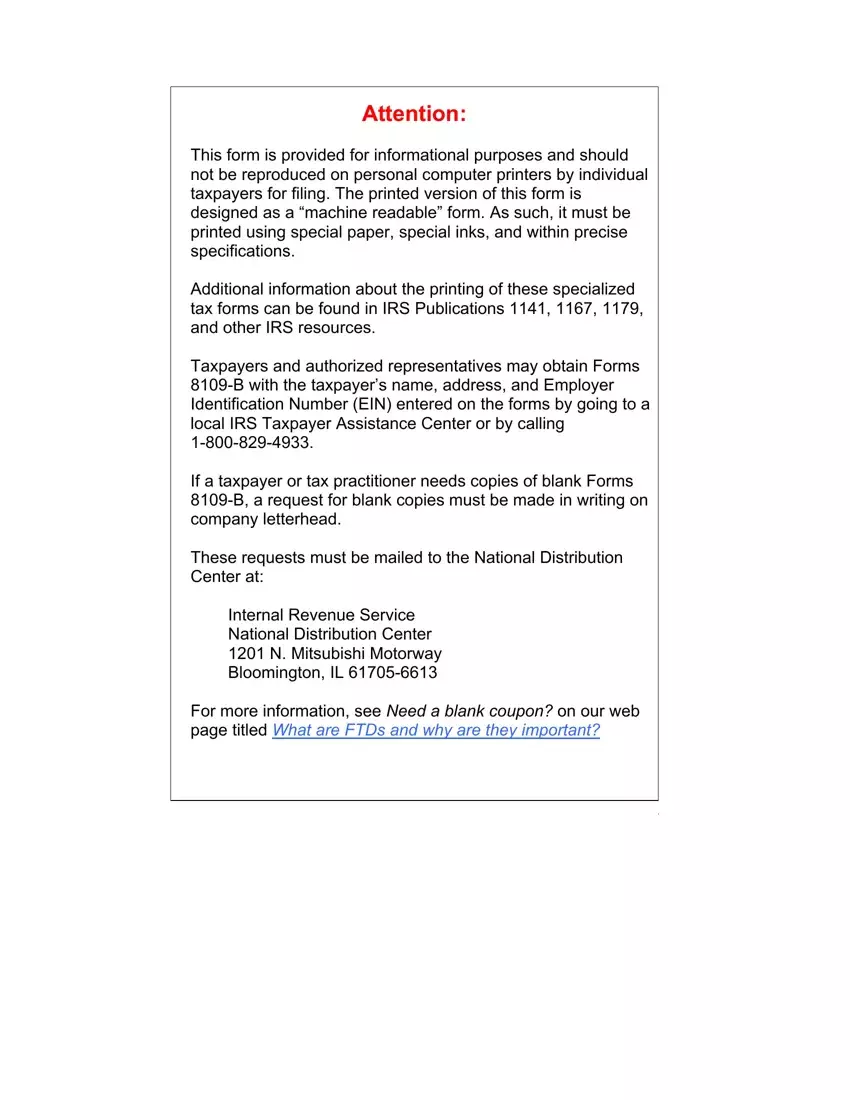

About Form 1040-V, Payment Voucher - IRS tax forms Forms and Instructions About Form 1040-V, Payment Voucher About Form 1040-V, Payment Voucher Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision Form 1040-V PDF Recent Developments None at this time. Other Items You May Find Useful › pub › irs-pdf2022 Form 1040-ES - IRS tax forms use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. Select the "balance due" reason for payment or, if paying with a debit or credit card, turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Nov 17, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465.

Payment coupon for irs. CA Form DE 88 - Payment Coupon - CFS Tax Software, Inc. CA Form DE 88 - Payment Coupon. Tax returns, wage reports, and payroll tax deposit coupons are no longer available without an approved e-file and e-pay mandate waiver. You must submit these forms electronically. If you have an approved waiver, you will automatically receive payment coupons and tax forms in the mail. Irs Estimated Payment Coupon - bizimkonak.com Listing Websites about Irs Estimated Payment Coupon. Filter Type: All $ Off % Off Free Shipping Filter Type: All $ Off % Off Free Shipping Search UpTo % Off: 50% 70% 100% $ Off: $50 $70 $100 . Filter By Time All Past 24 hours Past Week Past Month. Recently Searched › Best ... About Form 1041-V, Payment Voucher - IRS tax forms Forms and Instructions About Form 1041-V, Payment Voucher About Form 1041-V, Payment Voucher Submit this voucher with your check or money order for any balance due on an estate's or trust's Form 1041. Current Revision Form 1041-V PDF Recent Developments None at this time. Other Items You May Find Useful All Form 1041-V Revisions Printable 2021 Federal Form 1040-V (Payment Voucher) - Tax-Brackets.org More about the Federal Form 1040-V Voucher. We last updated Federal Form 1040-V in January 2022 from the Federal Internal Revenue Service. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government.

Payment Coupon For Irs - bizimkonak.com About Form 1041-V, Payment Voucher - IRS tax forms. CODES (8 days ago) All Form 1041-V Revisions. About Publication 559, Survivors, Executors, and Administrators. About Form 1041, U.S. Income Tax Return for Estates and Trusts. Other Current Products. … Payment Vouchers | Arizona Department of Revenue - AZDOR Payment Vouchers Form is used those who electronically files a tax return and is separately mailing payment for taxes not remitted with the tax form, when filed. State of Oregon: Oregon Department of Revenue - Payments Electronic payment from your checking or savings account through the Oregon Tax Payment System. ... Mail check or money order with voucher to: Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050; Cash payments must be made at our Salem headquarters located at: 2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms - Illinois Withholding (Payroll) Tax Forms 2022 IL-501 Payment Coupon Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL-501 online Click here to download the PDF payment coupon

Prior Year Products - IRS tax forms Payment Voucher 1997 Form 1040-V: Payment Voucher 1996 Form 1040-V: Payment Voucher 1995 Form 1040-V: Payment Voucher 1994 « Previous | 1 | Next » Get Adobe ® Reader ... › publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... For a stripped bond or coupon acquired after 1984, and before April 4, 1994, an accrual period is each 6-month period that ends on the day that corresponds to the stated maturity date of the stripped bond (or payment date of a stripped coupon) or the date 6 months before that date. › instructions › i1099intInstructions for Forms 1099-INT and 1099-OID (01/2022 ... Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ... Paying a Balance Due (Lockbox) for Individuals - IRS tax forms Overview This commercial third-party processing takes place through a contract with the Internal Revenue Service (IRS) and the Financial Management Service (FMS) and involves the use of the Form 1040-V, Payment Voucher. Some balance due taxpayers must send their voucher, payment and sometimes their return to a designated location (a lockbox bank).

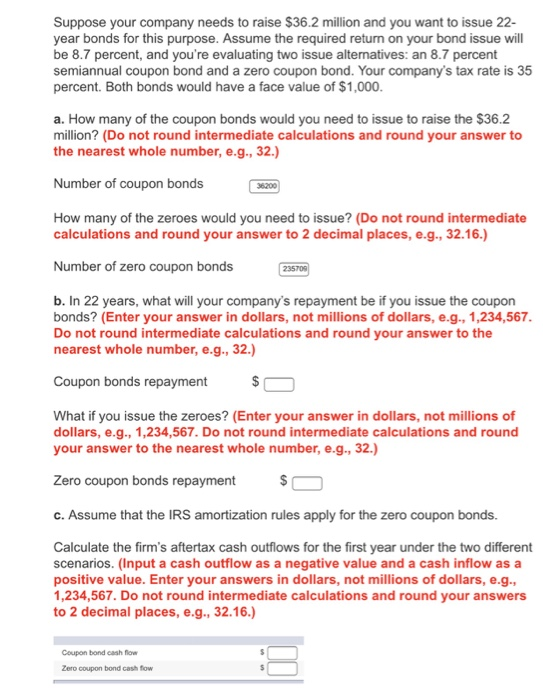

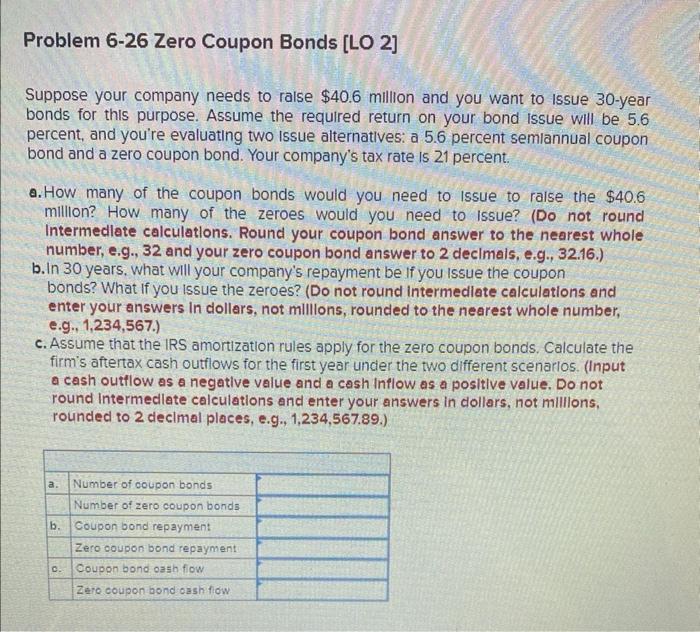

What is a Coupon Payment? - Definition | Meaning | Example Twenty years later, Mark earns his last payment of $300, plus his original investment of $10,000. In total, Mark has turned his $10,000 into $13,000 over 10 years, which was a safe, and smart, investment for him. Summary Definition. Define Coupon Payments: Coupon payment means the interest installment paid to bond holders.

Payment Vouchers - Michigan Payment Vouchers Below are the vouchers to remit your Sales, Use and Withholding tax payment (s): 2022 Payment Voucher 2021 Payment Voucher 2020 Payment Voucher 2019 Payment Voucher 2018 Payment Voucher 2017 Payment Voucher 2016 Payment Voucher 2015 Payment Voucher

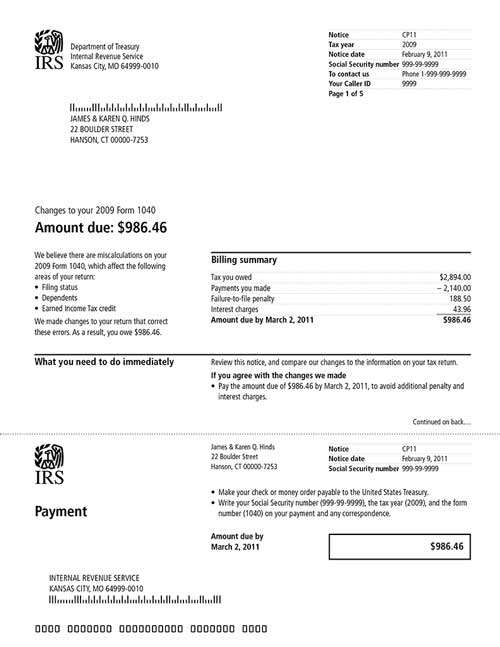

IRS payment options | Internal Revenue Service 2019 Tax Liability - If paying a 2019 income tax liability without an accompanying 2019 tax return, taxpayers paying by check, money order or cashier's check should include Form 1040-V, Payment Voucher with the payment. Mail the payment to the correct address by state or by form. Do not send cash through the mail.

IRS Payment Options With a 1040-V Payment Voucher - The Balance If You Can Pay Within 120 Days. The process is similar if you can pay off the tax you owe within six months. Send in a partial payment using Form 1040-V, and then wait for the IRS to send you a letter telling you how much you owe, including interest and late charges. Next, call the IRS at the number shown on the letter.

For those who make estimated federal tax payments, the first quarter ... Taxpayers can make an estimated tax payment by using IRS Direct Pay; Debit Card, Credit Card or Digital Wallet; or the Treasury Department's Electronic Federal Tax Payment System ( EFTPS ). If paying by check, taxpayers should be sure to make the check payable to the "United States Treasury."

› payPayments | Internal Revenue Service - IRS tax forms View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account Pay from Your Bank Account For individuals only. No registration required. No fees from IRS.

Form IT-2105, Estimated Tax Payment Voucher for Individuals Pay by credit card (2.25% convenience fee) Simply log in to your Online Services account, select the ≡ Services menu from the upper left-hand corner of the page, choose Payments, bills and notices, then select Make a payment from the expanded menu. (You'll need to create an account if you don't already have one.)

Form 1040 V: Payment Voucher: Definition and IRS Filing Rules The payment voucher at the bottom of Form 1040-V should be detached and mailed with your tax return and payment. The voucher asks for four main pieces of information. Line 1: Your Social...

Estimated Taxes | Internal Revenue Service - IRS tax forms Go to IRS.gov/Account . Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax. Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes.

Make a Payment | Minnesota Department of Revenue You can make payments for taxes and fees online, from your bank account, or in person. If you received a bill from the Minnesota Department of Revenue and cannot pay in full, you may request an installment plan. For more information, see Payment Agreements. Bank Account [+] ACH Credit [+] Check or Money Order [+] Credit or Debit Card [+] Cash [+]

› publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... Go to IRS.gov/FreeFile to see if you qualify for free online federal tax preparation, e-filing, and direct deposit or payment options. VITA. The Volunteer Income Tax Assistance (VITA) program offers free tax help to people with low-to-moderate incomes, persons with disabilities, and limited-English-speaking taxpayers who need help preparing ...

3 Ways to Set Up a Payment Plan with the IRS - wikiHow Businesses are eligible for long-term payment plans if they owe less than $25,000. If you owe more than $50,000 but less than $100,000, you are only eligible for a short-term payment plan. Generally, you must pay the full amount you owe to the IRS in less than 120 days. 2 Gather the information you'll need to apply online.

PDF 2021 Form 1040-V - IRS tax forms • Mail your 2021 tax return, payment, and Form 1040-V to the address shown on the back that applies to you. How To Pay Electronically. Pay Online. Paying online is convenient, secure, and helps make sure we get your payments on time. You can pay using either of the following ... Payment Voucher.

Estimated Tax Payment Coupon Irs - bizimkonak.com Category: coupon codes Show All Coupons Estimated tax payments FTB.ca.gov - California CODES (4 days ago) WebGenerally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and … Visit URL Category: coupon codes Show All Coupons

Payment Coupon Templates - 11+ Free Printable PDF Documents Download Payment Coupon Templates - 11+ Free Printable PDF Documents Download A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices.

turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Nov 17, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465.

› pub › irs-pdf2022 Form 1040-ES - IRS tax forms use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. Select the "balance due" reason for payment or, if paying with a debit or credit card,

About Form 1040-V, Payment Voucher - IRS tax forms Forms and Instructions About Form 1040-V, Payment Voucher About Form 1040-V, Payment Voucher Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision Form 1040-V PDF Recent Developments None at this time. Other Items You May Find Useful

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

![PDF] Effectively Hedging the Interest Rate Risk of Wide ...](https://d3i71xaburhd42.cloudfront.net/18233f62b9e6a600c60da3aaf727e60296c095bb/6-Table1-1.png)

Post a Comment for "44 payment coupon for irs"