45 coupon rate treasury bond

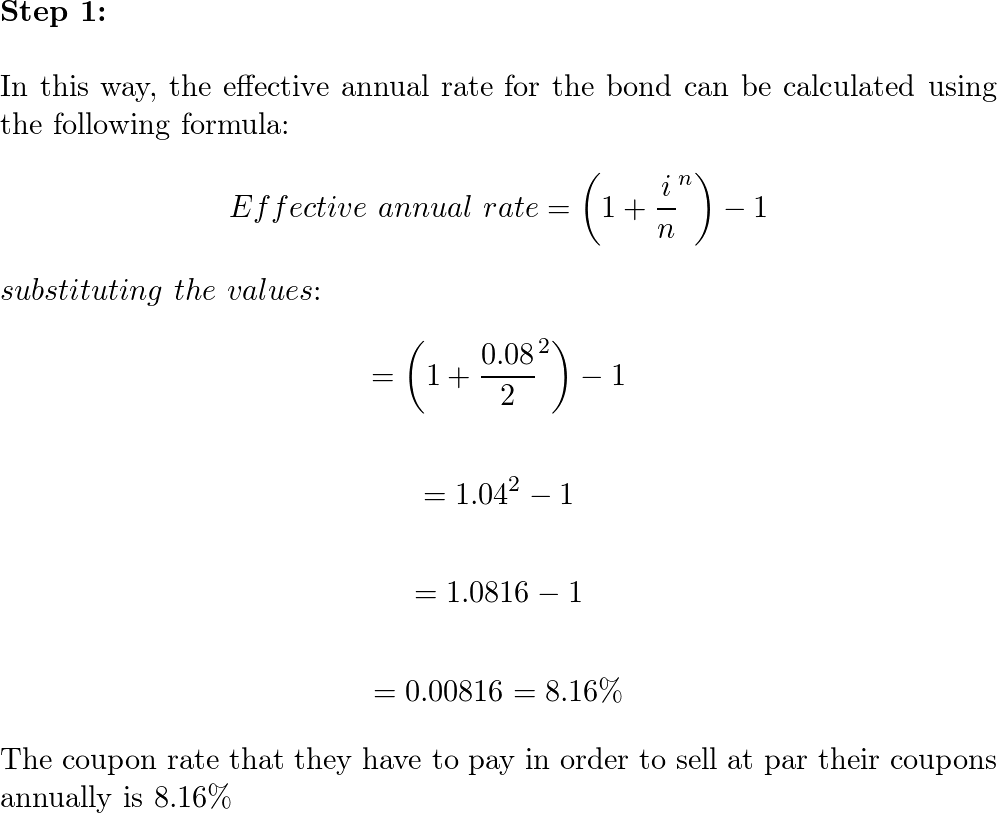

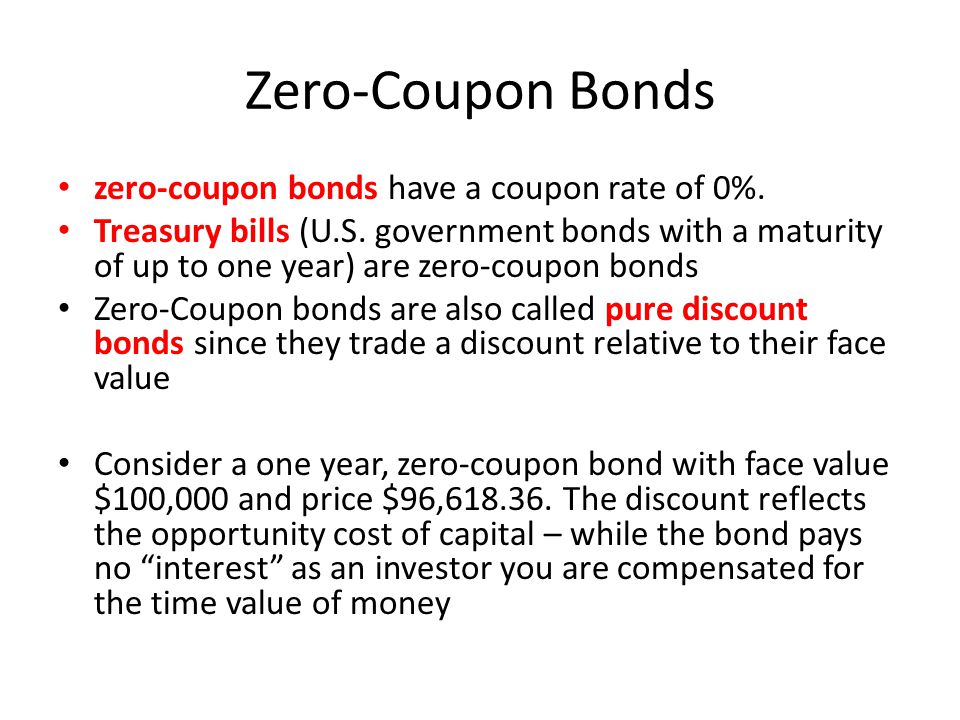

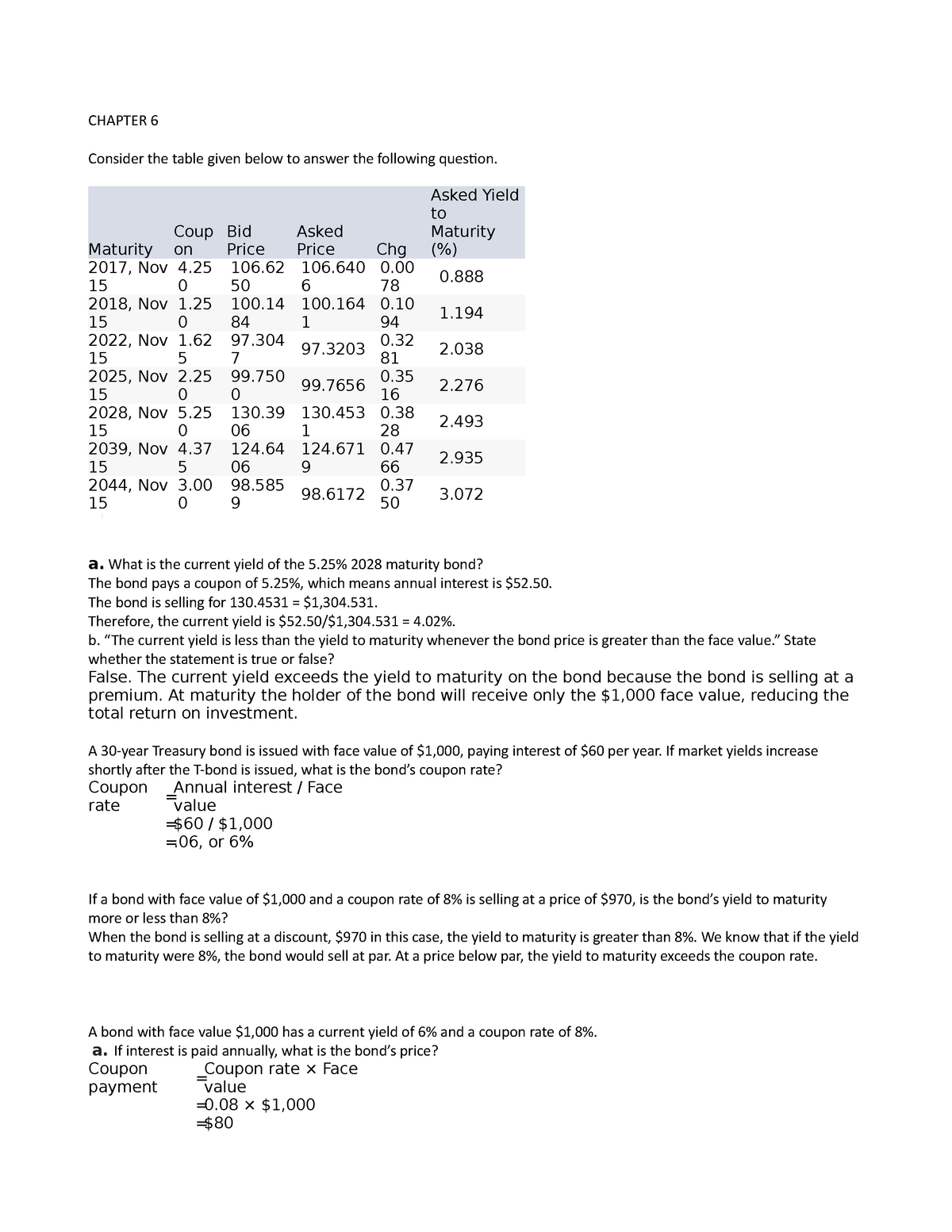

Coupon Rate of a Bond - WallStreetMojo Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par. Since the coupon (6%) is higher than the market interest (5%), the bond will be traded at a premium. Drivers of Coupon Rate of a Bond US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Coupon rate treasury bond

Interest Rate Statistics | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data ... this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon rate treasury bond. Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national government-controlled interest rates, as reflected in... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury …

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Aug 29, 2022 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ... Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up... I bonds interest rates — TreasuryDirect The composite rate for I bonds issued from November 2022 through April 2023 is 6.89%. Here's how we got that rate: Interest rate changes depend on when we issued the bond Although we announce the new rates in May and November, the date when the rate changes for your bond is every 6 months from the issue date of your bond.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Treasury Bonds | CBK Most bonds auctioned by the Central Bank are fixed coupon Treasury bonds, which means that the interest rate associated with the bond will not change over the bond’s life, so semiannual interest payments from these bonds will stay the same. ... If the bond has a pre-determined coupon rate in the prospectus, you should choose Non-Competitive ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Who sets the coupon rate for treasury bonds? : r/bonds - reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2.

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

› ask › answersHow Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ...

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... The Treasury yield is the interest ...

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Treasury Coupon Issues The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS).

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face...

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

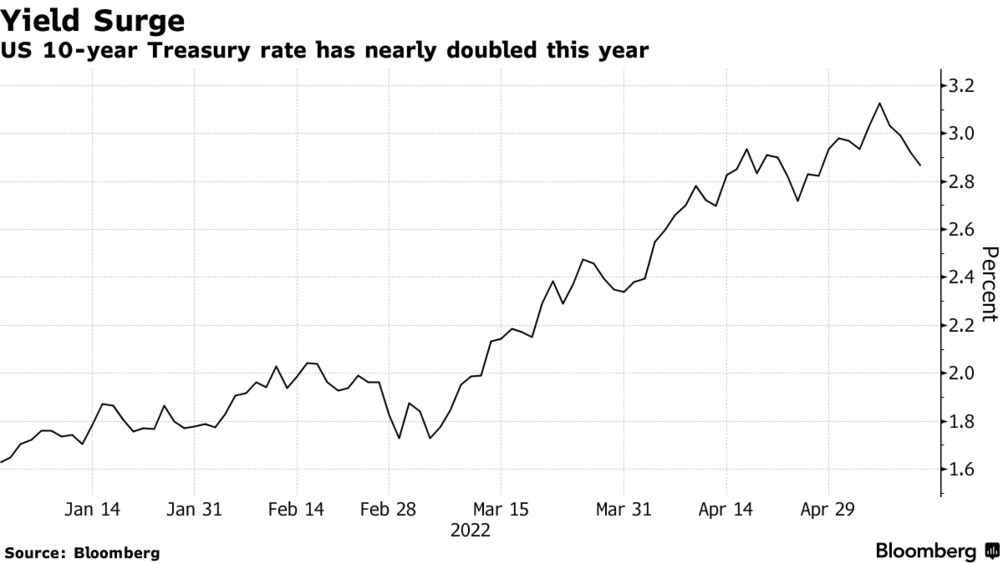

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of November 01, 2022 is 4.07%.

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73.

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a...

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year …

Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Interest Rate Statistics | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data ... this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not ...

Post a Comment for "45 coupon rate treasury bond"