39 coupon rate bond formula

Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

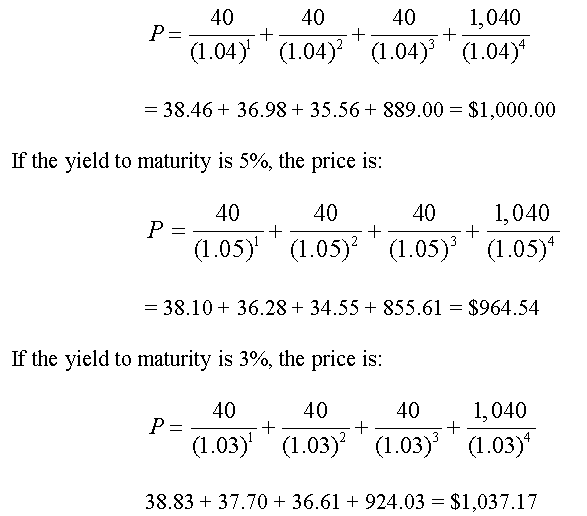

Bond Pricing Formula | How to Calculate Bond Price? | Examples Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n or Bond Price = C* (1- (1+r)-n/r ) + F/ (1+r)n You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and n = No. of periods till maturity

Coupon rate bond formula

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

Coupon rate bond formula. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Ch 6 - Exercise - Q20 interest rate risk and coupon rate.xlsx - Bond ... View Ch 6 - Exercise - Q20 interest rate risk and coupon rate.xlsx from FIN 921 at University of Wollongong. Bond Valuation FIN 921 Ch 6 Q 20 Bond Price Formula = discount rate 4% Bond J 14% Bond Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond pricing formula. Show more Calculating... Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Bond Pricing Formula |How to Calculate Bond Price? - EDUCBA Bond Price = ∑ (Cn / (1+YTM)n )+ P / (1+i)n Where n = Period which takes values from 0 to the nth period till the cash flows ending period Cn = Coupon payment in the nth period YTM = interest rate or required yield P = Par Value of the bond Examples of Bond Pricing Formula (With Excel Template) What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

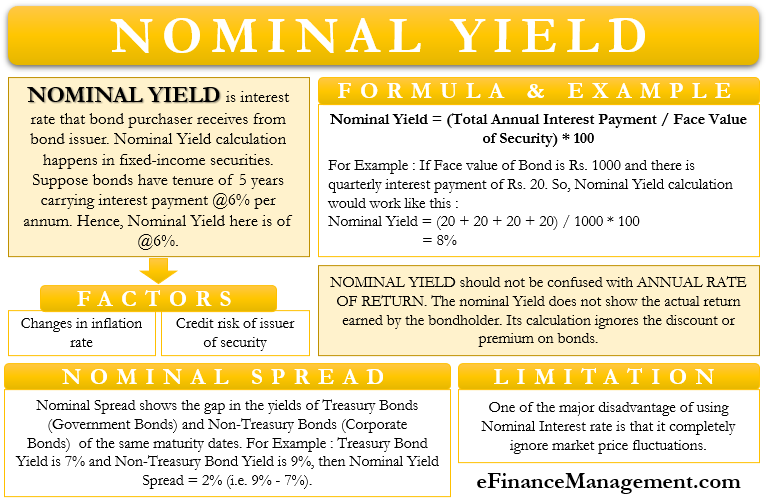

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

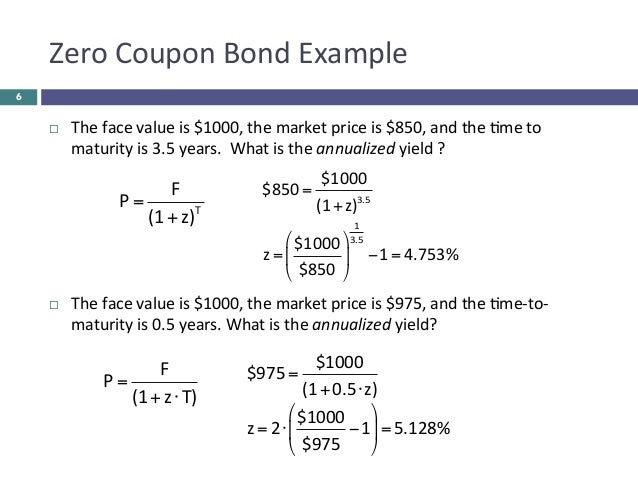

Zero-Coupon Bond: Formula and Excel Calculator If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0%) ^ 20. PV = $554. The price of this zero-coupon is $554, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return.

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

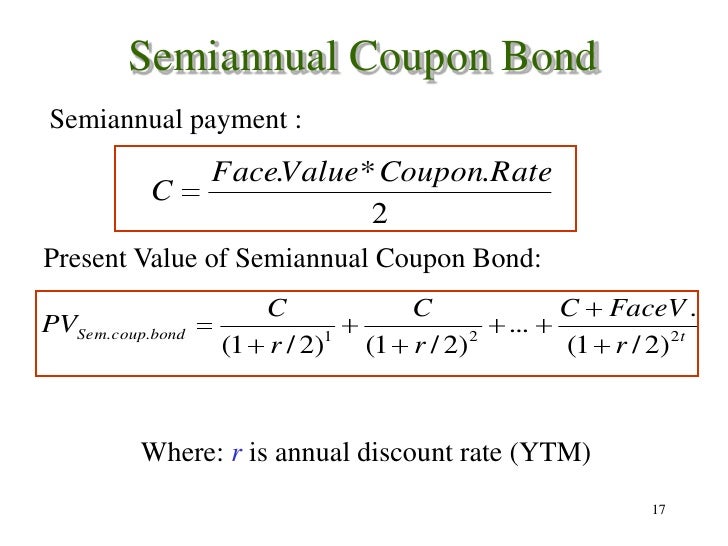

Bond Formula | How to Calculate a Bond | Examples with Excel Template Bond Formula - Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Coupon Rate: Definition, Formula & Calculation - Study.com How much will the coupon payments be of a 25-year $1,000 bond with a 5% coupon rate and quarterly payments? Suppose 10-year AAA bonds are currently issued at par to yield 5.5%.

Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where

Post a Comment for "39 coupon rate bond formula"