38 coupon rate and ytm

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as … Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return …

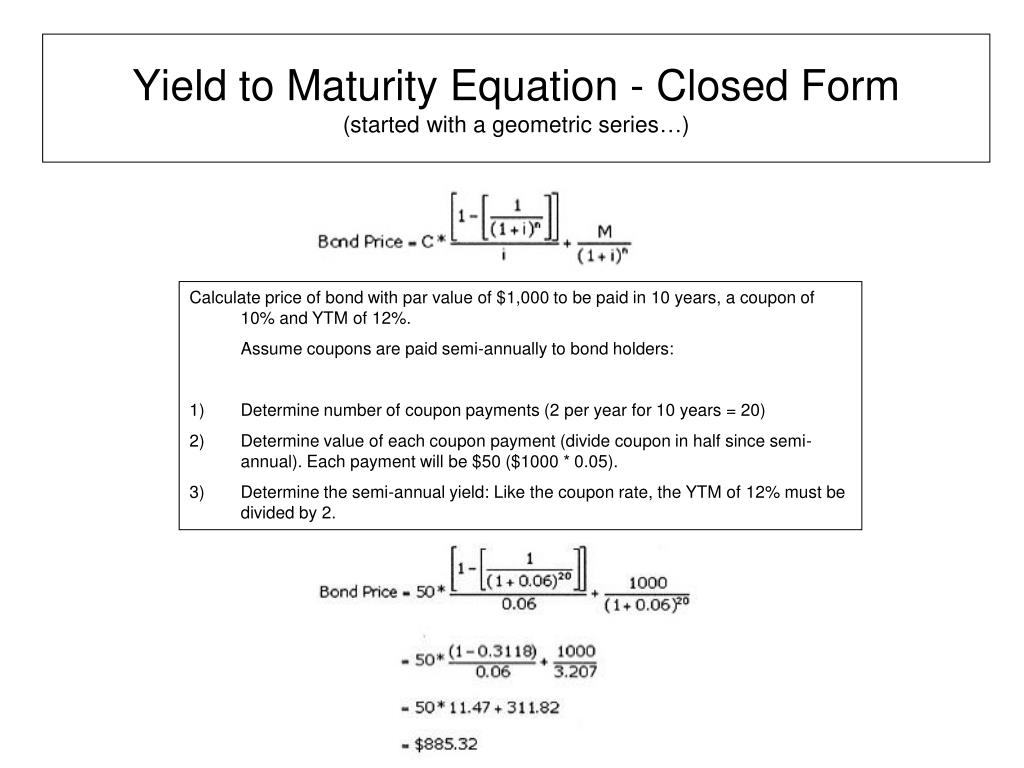

How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Use the formula = (((/ (+))) /) + / ((+)), where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15.

Coupon rate and ytm

Coupon Rate - Meaning, Calculation and Importance The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%. Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes Suppose we receive a semi-annual coupon at the rate of USD 3 per annum forever. Suppose further that the yield to maturity is 6%. Then, the present value of the perpetuity is $$\frac{3}{0.06}=\text{USD 50}$$ The Relationship between Spot Rates and YTM. We can use both the spot rate and the yield to maturity to determine the fair market price of ... Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Coupon rate and ytm. How to Calculate the Price of Coupon Bond? - WallStreetMojo Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond. Coupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula.

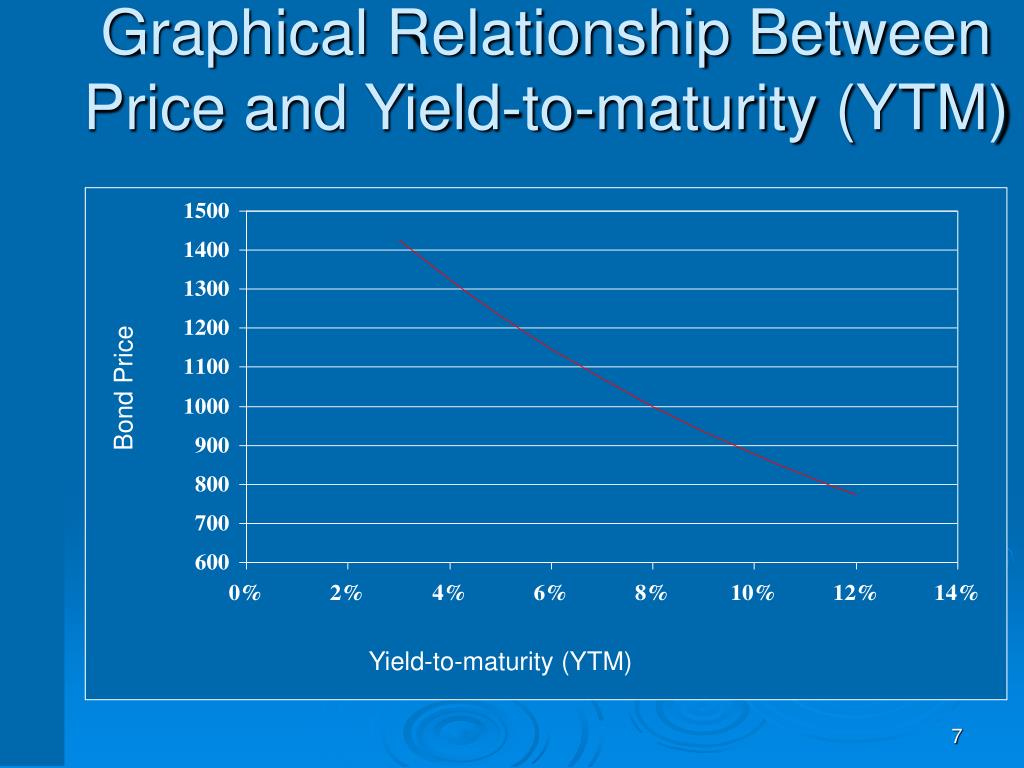

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%. Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.... Yield to Maturity | Formula, Examples, Conclusion, Calculator P = Price. n = Years to maturity. This is the most accurate formula because yield to maturity is the interest rate an investor would earn by reinvesting every coupon payment from the bond at a constant rate until the bond reaches maturity. If you had a discount bond which does not pay a coupon, you could use the following formula instead: Y T M ... Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond …

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity (YTM) Calculator Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity. Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve. Solved A bond has $1,000 face value, coupon rate of 5.8%, | Chegg.com A bond has $1,000 face value, coupon rate of 5.8%, and yield to maturity (YTM) of 6.2%. It will mature in 10 years and the interest rate will compound semiannually. What is this bond's current yield? 5.98% O 6.02% O 5.12% O 6.45%; Question: A bond has $1,000 face value, coupon rate of 5.8%, and yield to maturity (YTM) of 6.2%. It will mature in ...

When is a bond's coupon rate and yield to maturity the same? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Relationship Between Coupon and Yield - Assignment Worker YTM with Semiannual Coupons. Suppose a bond with a 10% coupon rate and semiannual coupons, has a face value of $1,000, 20 years to maturity and is selling for $1,197.93. 40 N. 1197.93 PV (negative) 1000 FV. 50 PMT. CPT PV 4% (= ½ YTM) YTM = 4%*2 = 8%. NOTE: Solving a semi-annual payer for YTM. results in a 6-month yield. The calculator & Excel

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Yield to Maturity (YTM): Formula and Excel Calculator What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made …

Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Post a Comment for "38 coupon rate and ytm"